The smart Trick of Bankruptcy Lawyers Near Me That Nobody is Discussing

Wiki Article

Bankruptcy Lawyers Near Me - Truths

Table of ContentsBankruptcy Attorney Near Me Fundamentals ExplainedThe Greatest Guide To Bankruptcy AttorneyOur Bankruptcy DiariesThe Facts About Bankruptcy Lawyers Near Me RevealedThe 6-Second Trick For Bankruptcy Attorney Near MeThe Main Principles Of Bankruptcy Attorney

Leinart Law practice want to provide details to ensure that you recognize the details of both of these terms in addition to the other types of personal bankruptcy you should be thinking about bankruptcy as a strategy. Debtor: the person or organization filing bankruptcy. A borrower as well as spouse can file a joint request in bankruptcy.

Bankruptcy Benefits for Beginners

The borrower's crucial "duty" is just to be truthful and cooperative throughout the procedure. Lender: the individual or service which has an insurance claim against a borrower. That claim is commonly merely for an amount of money owed on a debt, yet can also include responsibilities on a contract or for an injury that are not of a certain amount.They often tend to be much more entailed if they have collateral safeguarding their claim, or have some individual axe to grind (such as ex-spouses and ex-business companions). Insolvency Staff: the individual, and all of his or her workers, that deal with the clerical facets of the personal bankruptcy court (bankruptcy business). These individuals accept your situation for declaring, maintain your insolvency file, as well as handle most of the documents concerning your insolvency case.

Facts About Bankruptcy Attorney Revealed

So you will not likely have anything directly to do with the staff's office. Personal bankruptcy Judge: the person that is ultimately in charge of your situation. Personal bankruptcy judges are appointed to regards to 14 years. They are "judicial officers of the USA district court," not complete federal courts. In a lot of uncomplicated Chapter 7 and 13 cases, you will not have any event to satisfy the bankruptcy court appointed to your case.In lots of methods, bankruptcy can assist people and family members obtain a clean slate (bankruptcy business). Here are a few of one of the most common reasons people declare insolvency. Unemployment or an abrupt decrease of earnings is an additional top reason people file insolvency, especially if the borrower is the major carrier for their family members.

The Ultimate Guide To Bankruptcy

Minimum repayments are made but interest maintains building up. Quickly a $50 acquisition is currently $150 because of interest and also late costs. While financial debt loan consolidation can assist, often personal bankruptcy is the only way to reach a better financial future as financial debt loan consolidation requires that all (or most) of your financial obligation be repaid while personal bankruptcy can totally wipe out the financial obligation.

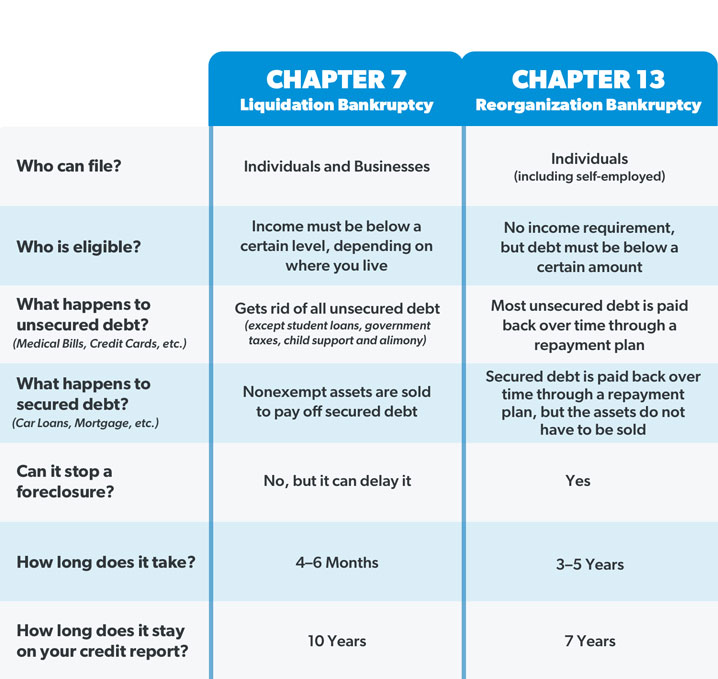

Based upon the details of your instance, you will desire to file under a particular phase. The various bankruptcy alternatives are arranged into various "Chapters" based on where each is found in the U.S. Bankruptcy Code. Phases 7 and 13 are primarily made use of by individuals with tiny business or customer financial obligation.

How Bankruptcy Australia can Save You Time, Stress, and Money.

/GettyImages-184324155-1ae5c089b1c840c3a9070ac039027d78.jpg)

amount of consumer and/or company financial obligation. Nonetheless, this is mainly for firms. Phase 9 is for city, area, and also other governmental bankruptcies.Chapter 9: a restructuring of debts of a city, county, or other subdivisionof a state.Extremely couple of are filedduring the last 30 years approximately of this Chapter's existence, in between just 1 to 18 cases have actually been submitted per year.Chapter 11: a" reorganization "of financial debts. It takes a great deal of thought as well as preparation in order to identify if bankruptcy is best for yourscenario. There are a number of factors why people pick insolvency and also there are necessary points to think about. Right here are a few points that you should think about when making a decision whether to file for bankruptcy. You should be qualified for filing. This is established by your financial obligation, kind of debt, earnings, your ability to pay, and various other aspects. If you consult with a personal bankruptcy lawyer, they can provide you an excellent suggestion if you would qualify, as well as otherwise, what other options he said are offered for you. However, owing money can commonly be even worse. Insolvency can help you obtain back on course financially; you simply have to weigh the advantages and determine whether it is the most effective fit for you. Recently, a number of web sites, publications, and also do-it-yourself sets have actually appeared, offering guidance and also support in just how to declare insolvency without an attorney. When filling out forms, it is important that the appropriate details be offered as well as details lawful treatments adhered to.

A Biased View of Bankruptcy Information

If you filed under Chapter 13, any type of house or cars and truck debts( the quantity you are behind)and any various other financial obligation being handled via the bankruptcy will certainly be rolled into the regular monthly settlements collected by the personal bankruptcy trustee. Even if your company in some way discovers out that you have actually submitted for bankruptcy, under the law they can't do anything to you since of your insolvency alone. The insolvency process is controlled by the Federal Regulations of Bankruptcy Procedure(or the"Insolvency Rules" )and also the regional policies of each insolvency court.Report this wiki page